How to Manage Capital in Roulette Games to Be More Measurable

Roulette is simple in structure but volatile in short-term results. Because every spin is independent, outcomes can cluster in streaks or swing unexpectedly. Therefore, the most important skill in roulette is not predicting numbers—it is managing capital carefully.

Roulette bankroll management is the foundation of measurable results. While no strategy removes the house edge, disciplined capital allocation reduces emotional stress and protects sustainability. Consequently, players who approach roulette with financial structure tend to experience smoother sessions than those who rely on instinct alone slot gacor.

Understand the Mathematical Reality First

Most online and live platforms use European roulette with 37 pockets. Whether streamed from professional studios in Riga or played in traditional venues like Monte Carlo, the mathematical structure remains constant.

Each spin carries a fixed house edge (around 2.7% in European format). Therefore, long-term expectation favors the house. However, short-term sessions can vary widely due to variance.

Because of this, capital management must be designed to absorb short swings without triggering emotional overreaction.

Step 1: Define a Dedicated Session Bankroll

First and foremost, separate roulette capital from personal finances. A session bankroll should be money allocated specifically for entertainment risk.

For example:

- Decide on a fixed amount per session.

- Accept that this amount could be fully lost.

- Avoid replenishing funds impulsively mid-session.

By defining boundaries early, decision-making becomes more rational.

Step 2: Use Small Percentage Betting Units

One of the most effective forms of roulette bankroll management is percentage-based betting.

A measurable framework includes:

- Betting 1–2% of total bankroll per spin.

- Avoiding exposure beyond 5% in a single round.

For instance, if your bankroll is 100 units, a standard bet should remain around 1–2 units. As a result, even a five-spin losing streak only impacts 5–10% of capital.

This approach stabilizes variance and protects against emotional escalation.

Step 3: Set Clear Stop-Loss and Profit Limits

To keep results measurable, define both downside and upside boundaries.

- Stop-Loss Limit: Protects capital from deep drawdowns.

- Profit Target: Locks in gains before variance reverses.

For example, a 20% stop-loss and a 15–25% profit goal create structured session endpoints. Importantly, once either limit is reached, the session should end.

Without predefined limits, players often chase outcomes, which increases volatility.

Step 4: Avoid Aggressive Progression Systems

Many players use doubling systems (like Martingale) to recover losses quickly. However, these methods expose capital to exponential risk during streaks.

Although even-chance bets (red/black, odd/even) may feel safer, long losing runs still occur naturally. Therefore, escalating bet size aggressively can deplete bankroll rapidly.

Instead, flat betting or mild, capped progression keeps exposure controlled.

Step 5: Choose Bet Types Based on Volatility

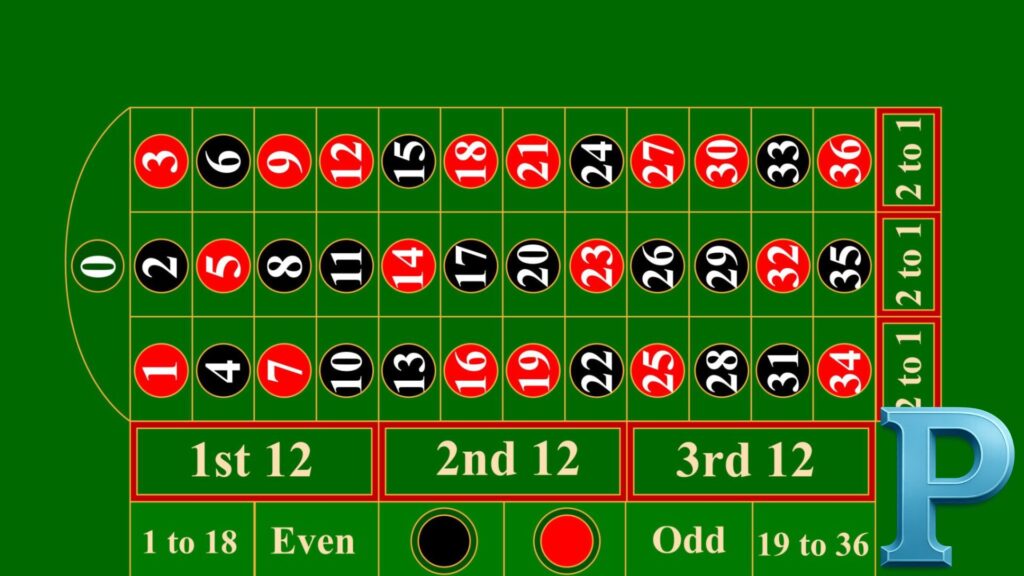

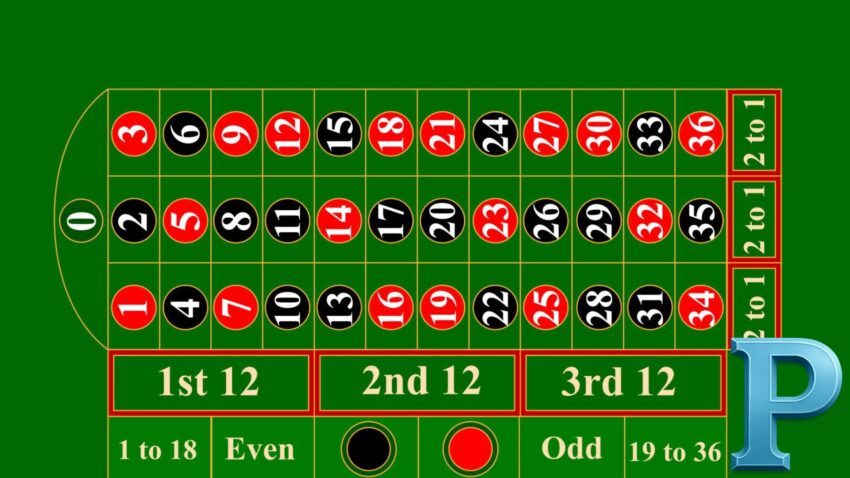

Not all bets create equal variance.

- Even-chance bets: Lower volatility, steadier fluctuation.

- Dozens and columns: Moderate variance.

- Single-number bets: High volatility, larger swings.

For more measurable results, many disciplined players prioritize even-chance wagers because fluctuations remain smoother.

However, regardless of bet type, unit size must remain consistent.

Step 6: Track Performance Objectively

Modern digital platforms provide detailed result history. Therefore, reviewing session performance helps identify emotional triggers.

Consider tracking:

- Total spins played

- Average bet size

- Maximum drawdown

- Session profit/loss percentage

By analyzing performance numerically, emotional bias decreases.

Step 7: Manage Session Duration

Fatigue reduces discipline. Therefore, measurable capital management also includes time control.

For example:

- Limit sessions to a fixed duration (e.g., 60–90 minutes).

- Take short breaks after intense streaks.

- Avoid playing when emotionally stressed.

Shorter sessions often reduce impulsive decisions.

Understanding Variance Acceptance

Even with disciplined roulette bankroll management, variance remains unavoidable. Some sessions will reach stop-loss limits quickly. Others may achieve profit targets early.

The goal is not eliminating risk but regulating it.

By limiting exposure per spin and defining exit conditions, players transform unpredictable outcomes into controlled financial events.

Long-Term Perspective

Over many sessions, disciplined capital management smooths volatility. Although roulette maintains a fixed house edge, structured exposure prevents dramatic swings.

In measurable roulette play:

- Capital lasts longer.

- Emotional reactions decrease.

- Decisions remain consistent.

Stability comes not from predicting the wheel, but from controlling personal risk.

Conclusion

Managing capital in roulette games to be more measurable requires structure, discipline, and emotional neutrality. By defining a dedicated session bankroll, betting small percentage units, setting clear limits, and avoiding aggressive progression systems, players reduce volatility significantly.

Ultimately, roulette bankroll management does not change probability. Instead, it changes how probability affects you. When exposure is controlled and boundaries are respected, sessions become more stable, predictable, and sustainable over time.

Cek Juga Artikel Gacor Dari Platform : quotesbook